Relying on a storage facility's locks and cameras alone is a bit like having a strong front door but no contents insurance for your home. It’s a risky move. You absolutely need dedicated insurance for contents in a storage unit to act as a financial safety net against things like fire, theft, or water damage—events that even the most secure facilities can’t completely prevent.

Why Your Stored Belongings Need Proper Insurance

Think of your storage unit as your own personal vault. While we at Shield Self Storage provide top-notch physical security—things like 24/7 CCTV and secure keypad entry—that’s only half the story. The key thing to grasp is the difference between physical security and financial protection. It’s like a bank vault; the vault itself is incredibly secure, but you still insure the valuables inside, right?

A facility's own insurance typically just covers the building, not the items you place inside it. Your rental agreement will make it clear that you're responsible for your own belongings. This is where dedicated storage insurance becomes essential.

The Financial Safety Net You Can't Afford to Overlook

Without the right cover, you are personally on the hook for the full replacement cost of everything you store. Just imagine the financial hit if a fire broke out or a pipe burst in a unit nearby. Your belongings, from furniture and electronics to sentimental heirlooms, could be gone in an instant with no way to recover the cost.

The UK's self-storage industry is a big deal, valued at around £1.08 billion annually across more than 2,200 facilities. Given its scale, it’s standard practice for nearly all providers to ask for proof of insurance. This isn't just red tape; it's because most home insurance policies don't cover items stored off-site. On top of that, the average value of household contents has shot up to about £58,210—a massive 38% increase since 2019. You can read more about these storage insurance statistics in the UK.

Insurance for contents in a storage unit isn't just a box to tick on a contract; it's your personal guarantee that you can recover financially from an unexpected disaster. It bridges the gap between a secure space and total peace of mind.

This guide will walk you through your options clearly, helping you sidestep common mistakes like being underinsured. By the end, you'll be able to confidently pick the right cover, making sure your valuables are protected both physically and financially.

Your Three Main Insurance Options Explained

When it comes to insuring the contents of your storage unit, you’ve got a few different routes you can take. It’s not a one-size-fits-all situation, and understanding your options is the first step to making a smart choice for your belongings. Each path has its own mix of convenience, cost, and the level of protection it offers.

Think of it like choosing how to get to a destination: you can take the straightforward, signposted toll road, use your own map with a bit of local know-how, or hire a specialist guide who knows all the shortcuts. Each will get you there, but the journey—and what it costs—will be quite different. Let’s break down your options.

Option 1: The In-House Policy From the Storage Facility

This is almost always the most convenient choice. When you sign the rental agreement for your unit, the facility will likely offer you their own insurance plan. Many, including Shield Self Storage, require you to have proof of insurance, and taking their policy is a quick and easy way to tick that box.

The main draw here is simplicity. You sort your unit and your insurance in one go, with the cost often just rolled into your monthly payment. No need to shop around or get quotes from other companies.

But that convenience can come at a price. Facility-provided insurance can sometimes be more expensive and might offer less comprehensive cover than other options. It’s the "toll road" option—fast and easy, but not always the most economical journey.

Option 2: Extending Your Existing Home or Tenant Insurance

You might already have the protection you need through your current home or contents insurance policy. This is often called "off-premises cover" or "goods in storage" cover, and it basically extends the safety net of your home insurance to protect your things while they’re stored elsewhere.

Before you assume you're covered, you absolutely must check the fine print or, better yet, speak directly with your insurer. Here are the key questions you need to ask:

- Does my policy include an 'off-premises' clause? Make sure it explicitly covers items kept in a self-storage facility.

- What’s the coverage limit? Most policies cap this at a percentage of your total personal property cover, often around 10%. So, if you have £40,000 of contents cover at home, your storage unit might only be insured for up to £4,000.

- Are there any specific exclusions? Ask if certain items or types of damage are excluded when they're in storage.

By checking your existing policy first, you could avoid paying for new insurance altogether. But it's vital to ensure the coverage limit is high enough to replace everything you've stored if the worst were to happen.

This route can be very cost-effective if the cover is sufficient. The biggest risk is that the limits are too low for the value of what you’re storing, leaving you underinsured and facing a big financial hit if you ever need to make a claim.

Option 3: A Standalone Policy From a Specialist Insurer

Your third path is to buy a dedicated policy from a third-party company that specialises in self-storage insurance. These insurers focus purely on this type of cover, which often means their policies are more tailored to the specific risks and more competitively priced.

This is your "specialist guide" option. These providers know the ins and outs of storage risks and design their policies to match. They often provide more comprehensive "new-for-old" cover, which means you’d get enough money to buy brand-new replacements for your items, not just what they were worth second-hand.

While it takes a bit more legwork—you'll need to get a few quotes and compare what’s on offer—the savings can be significant. For just a few minutes of research, you can often find better cover for a lower price than the in-house option. This approach gives you the most control and usually the best value, making it a popular choice for savvy storers.

Comparing Costs and What Your Policy Actually Covers

Figuring out the true cost of insuring your belongings in a storage unit is the first step to making a smart decision. While the in-house policy offered at the rental desk is undeniably convenient, taking just a few minutes to look around can often uncover options that are not only cheaper but also give you better protection.

Let's break down what you can expect to pay and, just as importantly, what you actually get for your money. Insurance policies can be full of jargon and tricky clauses, but once you know what to look for, you can choose a plan based on real value, not just how easy it is to sign up.

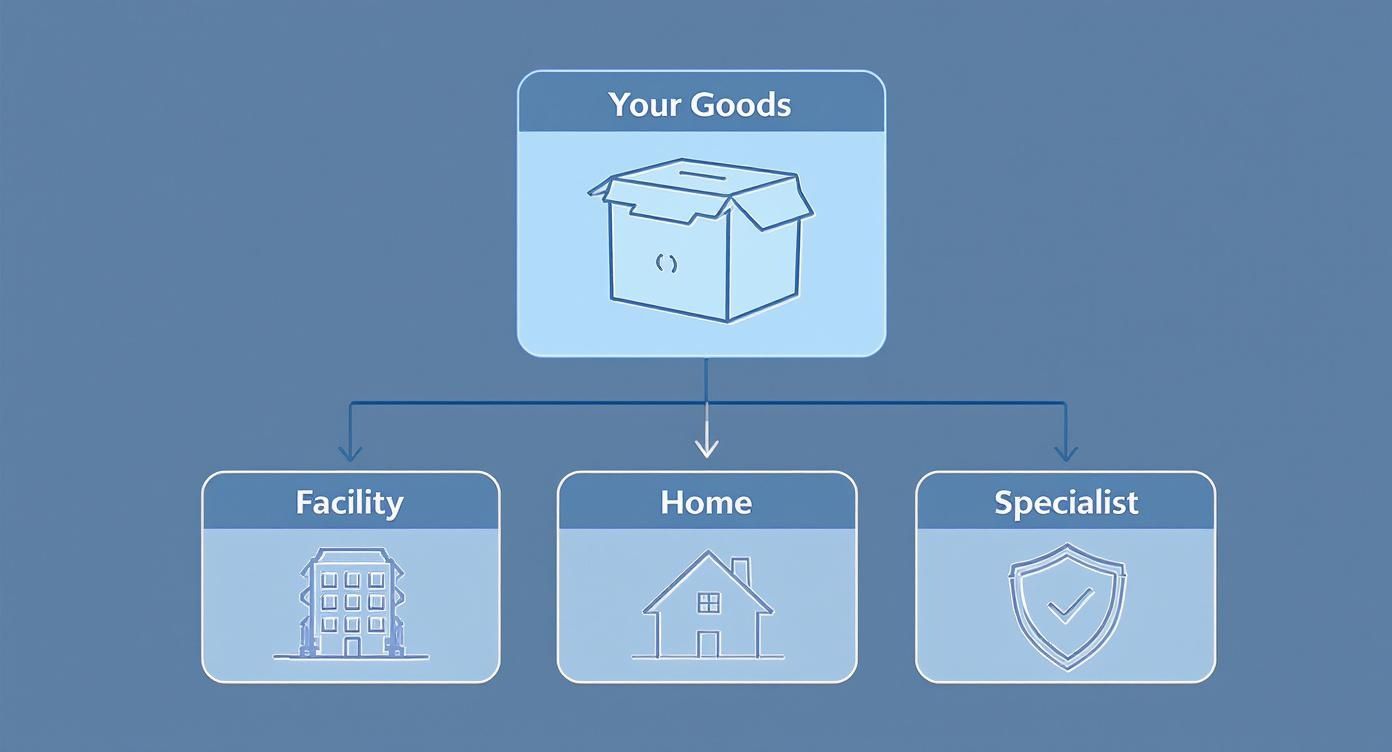

This diagram shows the three main routes for insuring your goods, each with its own costs and benefits.

As you can see, you can get cover directly from the facility, add it to your home policy, or go with a specialist insurer. This puts you firmly in control of your level of protection.

Decoding the Cost of Cover

The price you'll pay for storage insurance is almost always based on the total value of what you're storing. As a general rule of thumb in the UK, expect to pay somewhere between £1.50 and £2.50 per month for every £1,000 of cover you need. So, if you're storing items worth £5,000, your monthly premium would likely be between £7.50 and £12.50.

However, where you buy your policy from can make a massive difference to that figure. One detailed UK study found that customers buying insurance directly from the storage facility were quoted significantly higher prices than those available from independent insurers. In fact, many people could be paying up to three times more just for the convenience, which highlights a major price gap in the market.

This is exactly why shopping around is so important. The few pounds saved each month really add up over the year, especially if you plan on using storage for a longer period.

To help you see the differences at a glance, here’s a quick comparison of the three main options.

Comparison of UK Storage Insurance Options

| Feature | Facility In-House Insurance | Home Insurance Extension | Third-Party Specialist Insurance |

|---|---|---|---|

| Convenience | Very high – sign up on the spot | Moderate – requires calling your provider | Moderate – requires online research and application |

| Cost | Typically the highest option | Can be cost-effective, but may raise your premium | Often the most competitive pricing |

| Coverage | Usually basic, may have many exclusions | Limited cover, often excludes specific risks in storage | Comprehensive and tailored for storage risks |

| Claims Impact | No impact on home insurance | A claim could increase your main home premium | No impact on home insurance |

| Flexibility | Limited; tied to your storage rental | Varies; may not cover all types of items | High; policies designed specifically for storage |

As the table shows, what you gain in convenience with an in-house policy, you might lose in cost and comprehensive cover. It's always worth weighing up what matters most to you.

Understanding Key Policy Terms

Beyond the price tag, you need to get to grips with the language in your policy to know what you’re actually protected against. Two of the most important terms you'll come across are ‘new-for-old’ cover and the ‘average clause’.

-

New-for-Old Cover: This is the gold standard for contents insurance. It means if something is stolen or damaged beyond repair, your insurer pays out enough for you to buy a brand-new equivalent, not just its second-hand value. Always check if a policy offers this, as it provides far greater financial security.

-

The Average Clause: This is a common trap that can leave you seriously out of pocket. If you deliberately undervalue your goods to get a cheaper premium, and then need to make a claim, the insurer can reduce your payout proportionally. For example, if you insure £10,000 worth of belongings for only £5,000 (that’s 50% of their true value), the insurer is only required to pay out 50% of any claim you make, no matter how small.

It's vital to calculate the full replacement value of your items accurately. Not only does this ensure you have enough cover, but it also protects you from the sting of the average clause if you ever need to make a claim. For help with this, our guide on choosing the right size storage unit can help you take a proper inventory.

By getting a handle on these costs and terms, you can move from just buying a policy because you have to, to making an informed choice that properly safeguards your belongings.

A Step-By-Step Guide to Securing the Right Cover

Finding the right insurance for your things in storage can feel like a bit of a chore, but it's actually pretty straightforward when you break it down. By following a clear plan, you can confidently find protection that fits your needs and budget, giving you one less thing to worry about before you lock that unit door.

This guide will walk you through four essential steps, turning a potentially confusing task into a simple one. From totting up the value of your items to reading the small print, each step is designed to give you complete peace of mind.

Step 1: Create a Detailed Inventory and Calculate Its Value

Before you can insure your items, you need to know exactly what you’re storing and what they’re all worth. This is hands-down the most important step in getting the right level of cover, and it's essential if you ever need to make a claim.

Start by making a detailed list. Go through everything you plan to store and jot it down. Be specific—instead of just "sofa," write down "grey three-seater fabric sofa from DFS." Trust me, this level of detail is invaluable later.

Next to each item, estimate its replacement value. This isn't what you'd get for it on Gumtree; it’s what it would cost to buy a brand-new equivalent today. Once you've listed everything, add up all the values to get your total sum insured. Skimping here to save a few quid is a false economy that could leave you seriously out of pocket. For more guidance, check out our tips on preparing furniture for storage.

Step 2: Check Your Storage Facility's Requirements

Pretty much every storage facility in the UK, including us at Shield Self Storage, will require you to have insurance before you can rent a unit. It's standard practice and protects both you and the facility.

Before you start looking for quotes, have a good read of your rental agreement. It will tell you the minimum amount of cover you need. It'll also outline any other specific insurance-related rules you need to follow.

Understanding the facility's rules from the get-go saves you time and makes sure any policy you buy meets their criteria. It's a simple check that prevents any last-minute headaches when you're all set to move your things in.

Step 3: Compare Quotes From Different Providers

With your inventory list and total value sorted, it’s time to find the best deal. It can be tempting to just go with the in-house insurance offered by the storage provider for an easy life, but that's rarely the cheapest option.

Spend a few minutes comparing quotes online from specialist third-party insurers. You'll often find that these providers offer better cover for a lower price. When you're comparing, look beyond just the monthly cost and think about these things:

- The Policy Excess: This is the amount you have to pay towards any claim. A lower monthly premium might come with a higher excess, so find a balance that works for you.

- Coverage Type: Make sure the policy offers ‘new-for-old’ cover. This ensures you get the full replacement value for your items, not just their second-hand worth.

- Customer Reviews: See what other people are saying about their experience, especially when it comes to making a claim. A smooth claims process is worth its weight in gold.

Step 4: Read the Fine Print Before You Buy

This final step is arguably the most important of all: read the policy documents properly before you commit. The nitty-gritty details hidden in the terms and conditions will define what you’re actually covered for.

Pay close attention to the exclusions section. This part of the policy lists what is not covered, such as damage from mould, mildew, or pests. You should also get your head around the claims process, noting the deadlines for reporting an incident and what paperwork you’ll need to provide. For a broader look at contents insurance, you might find this complete guide to protecting valuables with contents insurance useful.

By taking the time to understand the policy in full, you can avoid any nasty surprises and be confident that the cover you've chosen is right for you.

Understanding Common Policy Exclusions

An insurance policy is defined as much by what it doesn't cover as what it does. Getting to grips with the small print is crucial for anyone taking out insurance for their storage unit, as it sets clear expectations and helps avoid disappointment if you ever need to make a claim.

While most policies offer a solid safety net against major events like theft, fire, and some types of water damage, they all come with a list of specific exclusions. These are simply the scenarios and items the insurer won't pay out for.

Standard Events Your Policy Likely Covers

Before we dive into the exclusions, let's quickly cover what you can typically expect your insurance to protect. Standard policies are built to cover sudden and unexpected events, which usually include:

- Theft that involves a clear, forced entry into your unit.

- Fire and lightning strikes.

- Flooding from burst pipes or other sudden water leaks inside the facility.

- Vandalism and malicious damage.

- Impact from vehicles or falling trees.

Think of these as the core protections that form the foundation of most storage insurance policies.

What Is Typically Not Covered

Now for the important part: the exclusions. Insurers leave certain things out because they’re either preventable through good care, happen gradually over time, or are just too high-risk to cover under a standard plan.

The most common exclusions you'll run into are:

- Mould and Mildew: Damage caused by damp, mould, or mildew is almost always excluded. This is seen as a maintenance issue that can be prevented with proper packing and ventilation. For tips on this, our guide on how to pack for moving and storage can be a massive help.

- Pest and Vermin Damage: Any destruction from insects, rodents, or other pests won't be covered. Choosing a clean, modern facility like Shield Self Storage helps minimise this risk in the first place.

- Gradual Deterioration: Insurance is for sudden disasters, not the natural ageing process. General wear and tear, rust, or items slowly breaking down over time are not covered.

- Flooding from Natural Disasters: While a burst pipe inside the facility might be covered, widespread flooding from a nearby river bursting its banks often requires a separate, specialised flood insurance policy.

Understanding these limitations isn't about finding fault with the policy; it's about being a smart consumer. Knowing what isn't covered allows you to take preventative steps to protect your belongings from those specific risks.

Prohibited and High-Value Items

Insurers also have a list of items that are either too risky, too tricky to put a value on, or simply aren't allowed in a storage unit to begin with.

You will almost certainly find that your policy does not cover:

- Cash, Securities, and Deeds: These are treated just like money and are always excluded.

- Flammable or Explosive Materials: Things like petrol, paint thinner, or fireworks are banned for obvious safety reasons.

- Food and Perishable Goods: These attract pests and are never allowed in storage.

- Living Things: Plants and animals cannot be kept in a storage unit.

- Certain High-Value Items: Expensive jewellery, fine art, and some collectibles may have very low coverage limits or be excluded entirely unless you have a specialised policy.

For high-value goods like jewellery, insurers are increasingly requiring periodic revaluations and even the installation of certified safes. The modern security safeguards found in facilities like ours can help reduce insurer risk, which may lead to more cost-effective insurance options for UK storage users.

How to Make a Claim for Your Stored Goods

It’s a horrible feeling. You arrive at your unit only to find your belongings have been damaged or stolen. It's the kind of moment that can leave you feeling completely overwhelmed. But having a clear plan of action makes all the difference. Following a few simple steps will not only help you stay calm but also massively improve your chances of a smooth and successful insurance claim.

What you do in those first few moments is critical. Before anything else, you need to act fast and in the right order to protect your claim. Think of it like securing an incident scene; your immediate actions lay the groundwork for everything that follows.

Your Immediate Action Checklist

The second you notice something is wrong, your priority is to document and report it. Don't put it off—most insurance policies have very strict time limits for reporting a loss.

-

Tell the Facility Manager Immediately: Let the team at Shield Self Storage know what’s happened. They can check the CCTV footage and secure your unit to stop any further issues. They'll also give you an incident report, which is a crucial piece of evidence for your insurer.

-

Contact the Police (If You Suspect Theft): If you think your items have been stolen, you must report it to the police straight away. They will issue a crime reference number, and your insurance provider will almost certainly need this to process a theft claim.

-

Inform Your Insurer: Get on the phone with your insurance provider as soon as possible to officially start the claims process. They will assign you a claims handler and talk you through the next steps.

Gathering the Necessary Documentation

This is where all that prep work you did earlier really pays off. The detailed inventory you made is no longer just a list; it’s now the backbone of your entire insurance claim. Your insurer needs solid proof of what was lost or damaged and what it was worth.

A well-documented claim is a strong claim. Your ability to provide clear, organised evidence of ownership and value is the single most important factor in ensuring a smooth and fair settlement from your insurer.

To get your claim moving, you’ll typically need to provide:

- Your Detailed Inventory List: This is your master record of everything involved.

- Photographs or Videos: Take clear pictures or videos of any damage to the unit itself and your belongings.

- Proof of Ownership and Value: This can be anything from purchase receipts and bank statements to professional valuations for high-value items.

- The Police Crime Reference Number: Absolutely essential for any claim involving theft.

- The Facility's Incident Report: This officially confirms the event was logged on-site.

Submitting a complete and well-organised file will cut down on the back-and-forth with your insurer, leading to a much faster resolution. If your claim for stored goods is unexpectedly denied, knowing the steps to take is crucial. For further guidance, you can learn how to fight back against a denied insurance claim from specialist resources.

Answering Your Final Questions on Storage Insurance

As we wrap things up, let's tackle a few common questions that pop up when people are arranging insurance. Getting these last few details sorted can give you real confidence in the cover you’ve chosen. Here are three of the big ones.

Do I Need Insurance if the Facility Has Good Security?

This is a great question and it gets right to the point. While a top-notch facility like Shield Self Storage has plenty of deterrents—like 24/7 CCTV and keypad entry—those features are all about prevention, not financial recovery.

Think of it like this: a solid front door with a good lock helps stop burglars, but it won’t buy you a new laptop if someone does manage to get in. Insurance is the financial safety net that pays to replace your things after the unexpected happens. Good security lowers the risk, but only insurance for your storage contents can put money back in your pocket.

Can I Insure Business Stock in a Personal Storage Unit?

It's pretty common for small businesses to use personal storage for stock, but insuring it is a whole different ball game. Your standard personal contents or storage insurance policy is almost always designed for household goods and will specifically exclude anything commercial.

If you’re storing items for your business—whether it’s stock, equipment, or documents—you’ll almost certainly need a proper commercial insurance policy. Trying to use personal cover for business items could make your policy completely invalid, leaving you with nothing if you need to make a claim. It’s always best to be upfront with your insurer about exactly what you’re storing.

Here's the bottom line: The purpose of the goods dictates the type of insurance you need. Personal policies cover personal items; business goods need business cover. Getting this wrong can be a very expensive mistake.

How Much Cover Do I Actually Need?

This is probably the most important calculation you’ll make. The golden rule is to insure your items for their full replacement cost, not what they’re worth second-hand. That means figuring out what it would cost to walk into a shop today and buy every single item again, brand new.

It can be tempting to undervalue everything to get a cheaper premium, but that’s a false economy. Insurers often have an "average clause" in their policies. In simple terms, this means if you’ve underinsured your belongings by 50%, they might only pay out 50% of your claim. Always take the time to create a detailed list and add up the new-for-old replacement values. It’s the only way to be sure you're fully protected and won’t be left short.

For a secure, modern, and accessible place to keep your belongings safe in The Wirral, look no further. Shield Self Storage offers flexible solutions backed by excellent security. Get your fast quote and book your unit online today at https://shieldselfstorage.co.uk.